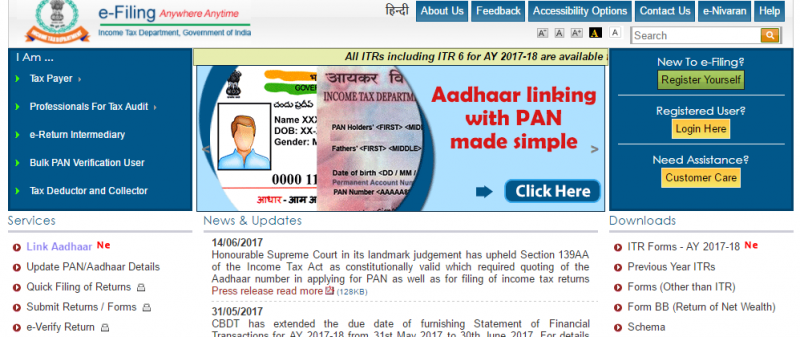

The government has recently made it compulsory to link your Aadhaar card to your PAN card for filing income tax returns. You can read about the different ways to link Aadhaar with PAN on the Income Tax department website here ( check this ). However, many people are facing problems while linking Aadhaar with PAN. Hence, this article gives solutions to problems faced while linking.

Why does Aadhaar – PAN linking fail?

Linking Aadhaar card with PAN card might be unsuccessful due to either of these two reasons –

- Mismatch in name, date of birth, or gender in Aadhaar and PAN details.

- You may have entered your Aadhaar number incorrectly.

- Technical error at UIDAI

So the first thing you have to do is check whether you have entered the correct number. Then compare the details on your Aadhaar card and PAN card to find if there is any mismatch.

Using Aadhaar OTP:

- Small differences in the name on both the cards are very common.

- If there is only a minor difference in the name (date of birth and gender are same), then you can proceed with the partial name match by authenticating using an Aadhaar OTP (One Time Password) sent to your registered mobile number or email.

However, sometimes there is a big difference in the name. Or maybe the date of birth and gender doesn’t match. Do not worry, you can still link the cards. There are two ways to solve this problem. You can either change your details on your Aadhaar card to match with those on your PAN card or vice-versa.

Update PAN Card Details:

- Go to the official Income Tax Department website.

- Click on ‘Update PAN/Aadhaar Details‘ under Services on the left-hand side column.

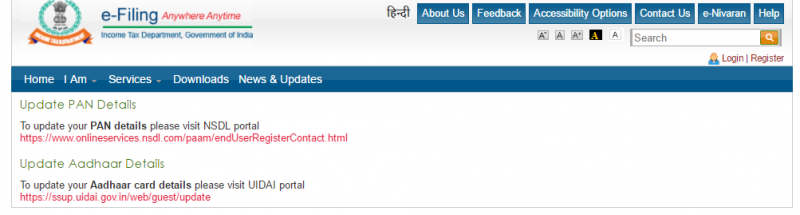

- On the next page, click on the link under ‘Update PAN Details‘.

- Then the NSDL website will open.

- Select ‘Changes or Correction in existing PAN Data‘ under Application Type.

- To read step-by-step instructions for making changes in PAN data, please click here.

If you are updating your details in your PAN card, keep in mind the following:

- PAN application processing fee is Rs.107.

- If you change the name in PAN, you will have to submit fresh KYC documents to your bank, insurance company, mutual funds, or any similar investments.

- You can also update your PAN card offline.

- You can contact NSDL for further information –

PAN Call Centre – 020 – 27218080

E-mail – [email protected]

Address – INCOME TAX PAN SERVICES UNIT, 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune- 411 016.

Update Aadhaar Card Details:

- Go to the official Income Tax Department website.

- Click on ‘Update PAN/Aadhaar Details‘ under Services on the left-hand side column.

- On the next page, click on the link under ‘Update Aadhaar Details‘.

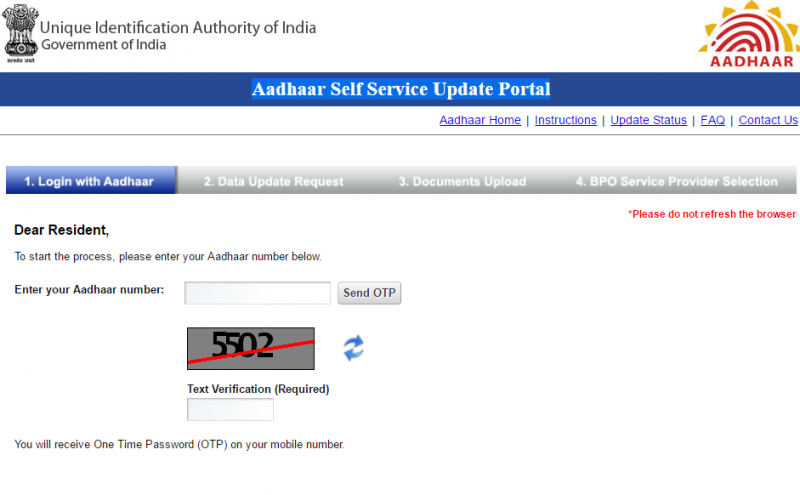

- The Aadhaar Self Service Update Portal page will open.

- Enter your Aadhaar number.

- For this process, you will need your Aadhaar card to be linked to your mobile number. This is because an OTP will be sent to the mobile number.

- Updating your Aadhaar card details is free of cost.

- You can also update your Aadhaar card details offline by downloading the form and then posting it.

Changing the name in Aadhaar using a scanned copy of PAN card:

- To change details in PAN or Aadhaar data is a little complicated and tedious.

- So the IT department has come up with an easier option if there is a discrepancy in name while linking Aadhaar and PAN.

- You can change your name on Aadhaar by logging onto the Aadhaar website, request for a name change, and then simply upload a scanned copy of your PAN card.

- However, for this method, your registered mobile number with UIDAI has to be functional.

So you can use either of the above-mentioned methods to link your Aadhaar card with PAN card. If you do not link your Aadhaar card to your PAN card, your PAN card may be blocked. The government is doing this to prevent people from evading income tax by having more than one PAN card.

Leave a Reply