State Bank of India (SBI) has been a much loved public sector bank over the time frame. With chairman as Arundhati Bhattacharya, SBI is growing at an enormous rate. Recently SBI came into the picture for its announcement of the SBI merger with its subsidiaries. This SBI merger was done to increase the productivity of the bank and also be able to serve common people efficiently.

What is the SBI merger?

SBI has merged with two major associate banks before. In 2008, SBI merged with State Bank of Saurashtra and in 2010 SBI merger took place for State Bank of Indore. Many financial experts believe this time the SBI merger was a political move. Despite the accusations, Arundhati Bhattacharya has clearly stated that there has been no political push for the merger. Also, the SBI merger won’t cause any major disruption in the banking for the people. The data integration shall be completed by the end of April for the merged banks.

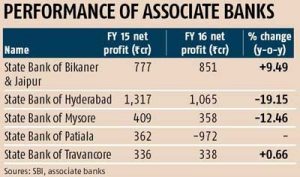

SBI merged with 5 of its associate branches on 1st April 2017. The five banks which merged with SBI are- State Bank of Bikaner and Jaipur (SBBJ), State Bank of Hyderabad (SBH), State Bank of Mysore (SBM), State Bank of Patiala (SBP) and State Bank of Travancore (SBT). Also, Bharatiya Mahila Bank merged with SBI.

Changes after the SBI merger

- First, post the SBI merger the bank now has 370 million customers, around 24000 branches, and nearly 59,000 ATMs.

- Also, there are no major changes in rules and regulations. The minimum average balance of INR 5000 in metros and INR 3000 in urban cities remains intac

- Finally, post-merger, SBI’s asset size should go up to Rs 28.6 lakh crore as on March. SBI is on its way to catch up with the competitors like HDFC Bank and ICICI bank.

- Currently, the IFSC codes of the merged banks will remain the same but are likely to be changed from July 2017.

FAQs for the merged bank customers

Should I register again post the merger?

There is no need to register. You can continue using your same user account details as before.

Will I get the same net banking facilities as before?

Yes, all SBI net banking facilities are similar. Thereby, you shall be able to use the same facilities.

Will the account numbers, cheque books, ATM card and passbook be valid after the merger?

As of now you can use the same account details. These might replace in three months time.

Are there any changes in service charges?

Yes, there will be a service charge levied on NEFT/ RTGS transactions after data level merger.

Will there be change in the name of the branch?

Some branch names have already changed. If the merged bank as well as SBI present in same location, older branch will retain its name. Moreover, SBI will provide a new branch name other.

Will the merger affect the banking rates?

Yes. Post the merger, SBI will charge as per the rules to all accounts.

If a customer has account in SBI as well as the merged bank, will the accounts be made into a single account?

No. The accounts will be under a single Customer Information File (CIF). The customer can request to merge the accounts, if required.

Will SBI consider the application of loan submitted to one the merged bank?

Yes. The loan process will happen in the same way. There might be a few documents you should resubmit.

Will the prepaid cards to the corporate account holders be applicable?

Yes. Also, the cards will function the same way and you can do top up through online mode.

Finally, for more queries, you can click here.

If this SBI merger was a good decision or a horrendous mistake, only time can tell.

May 27, 2017 4:56 pm

I HAVE ACCOUNT IN SBH & SBI SO WHAT ARE WE DOING?

June 27, 2017 10:24 pm

Now you will have 2 accounts in SBI

June 1, 2017 3:19 pm

After merger of State bank of patiala Rohini sector-13, branch, DDA Market what is the new IFS code of MICRO Code will my Account number remain same

June 3, 2017 5:34 pm

Till july 1st both new and old ifsc will work but after july 1st only new ifsc will work

June 20, 2017 1:36 pm

I want to know new ifsc code of sbop jaitu and chandbhan

July 28, 2017 8:43 pm

SBM of Ganganagar, Bangalore 560032, could anyone let me know the new ifsc code

August 5, 2017 11:47 pm

Hi, I’ve transferred amount to an Old SBT account/Old IFSC code on Aug 4th. The amount transferred from my account, but not credited to the account, to whom I sent. What will I do ?

August 6, 2017 11:41 am

Check with the bank, and take that in writing from the manager of why money is not transferred yet. Many people are facing problems because of that.

August 29, 2017 6:24 pm

I need to know that if my passbook info is needed for verification purpose to some institution for refund purpose…and now the ifsc code has been changed..I have the old passbook …so can I use the old one…or we should have to get new passbook

September 5, 2017 5:22 pm

You can use old passbook for now.

September 14, 2017 10:58 am

i have account in SBH Yellareddy guda ifsc code SBNY 0020653 After merged What s the Branch Ifsc code

September 23, 2017 1:41 pm

as i have maintain the savings account in SBT Madurai Simmakkal then after that bank will merged in SBI if i need new passbook and ATM cards can i apply any other SBI branch if any places please reply with me

January 16, 2018 4:50 pm

WHAT HAPPENS TY LOCKER IF THE SBM BRANCH IS CLOSED

October 1, 2020 3:23 pm

ON WHICH BASES sbi ALLOTED SHARES TO SBBJ SHAREHOLDERS ?

becz. before merger sbbj rate was around 8500/- (8500*35)and they have split 35 shares into 240 share of SBI and now sbi rate is 200/- (240*200), it means there is no benift to sbbj shareholders after merge in sbi

October 1, 2020 3:26 pm

Dear Sir,

I would like to request you that on what basis SBI i allotted shares to SBBJ Shareholders. as i have 35 shares of SBBJ and after merger SBI i allotted 240 shares.

before merger SBBJ share Rate was around 8500/- and after merger SBI rate is 200/-.

I thnik after merger shareholders have book a loss being profitable Bank before merger.