A bank uses the terms ledger balance and available balance to specify the position of funds in an account. Ledger balance is the balance available at the beginning of the day. On the other hand, the available balance may be defined in two ways, it is:

- Any plus or minus from the ledger balance via any subsequent activity of the day.

- The amount cleared via any cheques deposited into the account, as well as other credits to the account before the end of the day.

[toc]

What is Ledger Balance?

A ledger balance on the bank account of a customer is that balance displayed on the bank statement.

Ledger Balance = Credits for a given accounting period – the aggregate number of debits for a given accounting period . The ledger balance is different from an account’s available balance.

Available Balance = Balance available after any plus or minus in the account.

What is the difference between ledger balance and available balance?

You will find a ledger balance and an available balance when you are checking your account balance. Both the terms are used for your account balance but differ from each other. It may sound as if you should focus on your available balance, but the truth is that the ledger balance is your actual balance. The ledger balance includes only the credits and debits already cleared into your account.

It includes all the outstanding cheques, which have not cleared the account, along with the incoming funds that are not yet available. You should pay more attention to the ledger balance while determining whether you have enough balance to make a withdrawal or not. It is safe to use your ledger balance, as available balance will not show the amount not cleared.

Can you withdraw ledger balance?

When you withdraw money from your bank account, it shows a debit. This withdrawal will be shown in your ledger balance but there will be no change in the available balance until money is debited from your account. Therefore, when you withdraw money from your bank account, you always withdraw it from your ledger balance and not from your available balance. Finally, you can withdraw money from your ledger balance.

Explained with an Example:

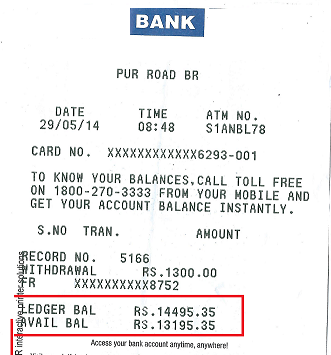

Check your ATM slip whenever you make a withdrawal from your account, it will never show the same amount of ledger balance and available balance. Suppose you withdraw INR 1300 from your account, and before withdrawal, the ledger balance was INR 14,495. After you made a withdrawal, the available balance for the day will become INR 13,195, while the ledger balance will remain the same INR 14, 495.

Thus, when you check your balance, after making a withdrawal, you may see two different balances, the ledger balance, and the available balance. This is because you have a pending transaction.

Below is the proper understanding of your account, check out the points:

- Suppose in the beginning of the day the amount in your account was INR 14,495. So, your ledger balance was INR 14,495.

- Now, you made a withdrawal of INR 1300. Now, your balance available becomes 14,495-1300 = INR 13,195. This is the available balance.

- If there was no other activity during the day in your account, then your balance at the end of the day is INR 13,195, which is now your ledger balance for the next day.

- But if you make an ATM withdrawal of INR 500 again on the same day then your ledger balance will remain INR 14,495 while the available balance will become INR 13,195 – 500 = INR 12, 695.

Ledger Balance Explained with another Example:

- Let us take another example, suppose you have a ledger balance of INR 20,000 in your account. Now, you write a cheque of INR 5,000, which is pending payment from your account.

- Now, you make a debit card purchase of INR 4,000. In this case, you have an available balance of INR 11,000 which you can withdraw from your account.

- According to the terms of your bank account, your ledger balance is INR 20,000 but you are eligible to withdraw only INR 11,000 from your account.

- You cannot withdraw the entire amount because INR 9,000 of the total amount if pending.

- Once your cheque is cleared and debit card payment is processed, your ledger balance will become INR 11,000.

- Remember that the available balance is always less than the ledger balance in a case where you make a withdrawal from your bank account.

However, when you will deposit some money into your account, your available balance will be more than your ledger balance.

- Suppose you have INR 20,000 in your account, which is your ledger balance. Now, you deposit INR 1,000, your available balance will become INR 21,000. However, the ledger balance will remain INR 20,000 until the transactions are cleared.

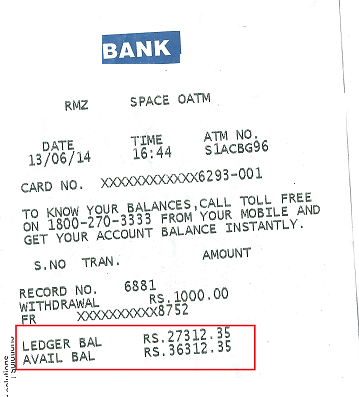

Let’s assume you deposited a cheque yesterday and money was transferred during the day. Then, the available balance will be more than the ledger balance.

- Suppose your ledger balance was INR 27,312. You deposit a cheque of INR 10,000, credited to your account. Then, your available balance becomes INR 37,312.

- Now, you withdraw INR 1,000 then your available balance becomes INR 36,312.

Your available balance includes the deposits or withdrawals, which are not cleared into your account yet. Look at the updated available balance in your account for the day. It is safe to check only available balance for a day. If a transaction is still to be cleared, the available balance may not show correct numbers.

On the other hand, if your ledger balance and available balance don’t match then wait for the day to end. The next day your bank records are updated with withdrawals and deposits in the last 24 hours. This will equalize your ledger balance and available balance until you make a new transaction for that day.

February 24, 2020 4:29 pm

i want to know abt the totall ledger related concern frm beginning to end