Want to find out how to get an income tax refund? This article explains all the basics of getting an income tax refund: the meaning, the procedure to claim a refund, how to check the status, the time taken to get the refund, the payment process, and late claims.

What is income tax refund?

You can get an income tax refund when you have paid more tax than your actual tax liability.[toc]

This usually happens because of either of the following reasons –

- You have paid more advance tax/self-assessment tax than your actual tax liability.

- TDS deducted is greater than your actual tax liability.

- You have not declared some investments which have tax benefits.

In such a case, you can claim an income tax refund.

What is the income tax refund procedure?

You claim a refund of the excess income tax paid by you during a financial year at the time of filing your income tax returns of that year.

How to claim income tax refund?

The process to claim an income tax refund is –

- Fill up the ITR form applicable to you online, or upload the filled excel/java utility form.

- After clicking on the validate button on the ‘Taxes paid and Verification’ sheet, the system will automatically calculate the refund due to you.

- The refund amount will show in the ‘Refund’ row.

- Please note that this is only the refund amount claimed by you as per your entered details. The actual amount paid (if any) will be determined by the Income Tax Department after processing your income tax return.

- After you file and verify your ITR, the Income Tax Department will verify your claim for a refund.

After processing your ITR:

In most cases, after processing the return, you will be sent an intimation under section 143(1).

- The intimation will show any one of the following –

1. That your tax calculation matches that of the IT department. And so you don’t have to pay any more tax.

2. That your tax calculation does not match that of the IT department. Either you have to pay some more tax, or your refund claim is rejected or reduced.

3. That your tax calculation matches that of the IT department. And your refund claim is accepted.

If you have e-filed your ITR online, the intimation will be sent to you via email. Normally, you will also be sent an SMS on your mobile number when your ITR is processed.

If your refund claim is accepted, the intimation states the refund amount. It will also state your refund reference number.

How to check income tax refund status?

You can easily check your refund status by following either of the two methods –

1. Income Tax Department e-filing website:

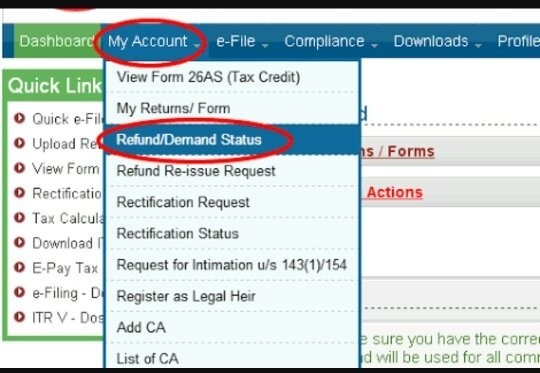

- Log on to the official IT department e-filing website.

- Log in with your user ID and password.

- Under the ‘My Account’ tab, click on ‘Refund/Demand Status’.

2. NSDL income tax refund status:

- You can also check your refund status by logging on to the refund status enquiry page of NSDL.

- Here you have to enter only your PAN and assessment year.

How does the IT department pay the income tax refund to you?

The IT department gives the refunds according to the ‘Refund Banker Scheme’. It has designated State Bank of India to pay the refunds to taxpayers.

After the Assessing Officers/CPC-Bangalore process the ITR, the refund amount is generated. On the next day of processing, it is transmitted to SBI, CMP branch, Mumbai to pay to the taxpayer.

SBI (Refund Banker) pays the refunds by either of the following two modes (depending on the option selected by you) –

- RTGS/NECS – SBI directly credits the refund amount to your bank account. For this, correct bank account number, MICR code, and communication address is necessary.

- Paper Cheque – For this, correct bank account number and address is necessary.

(Hence it is very important that you fill your correct bank details in the ITR form. And there is a specific row in the ITR form for filling the bank account details in which you want the refund.)

You can view the status of the refund 10 days after it has been sent by the Assessing Officer to the Refund Banker.

How long does it take to get income tax refund?

In case of e-filing ITR online, you should get the refund within two to six months. If you have filed your ITR physically, it may take longer.

Can you claim refund after filing the ITR?

If you forgot to claim a refund at the time of filing your ITR, you can do so using ‘Form 30‘. You can do it within one year from the last day of the relevant assessment year.

To claim a refund, is it necessary to file the ITR by the due date?

It is best to file your ITR by the due date. But you can also claim a refund while filing a belated ITR.

Helpline number and email ID

For queries and complains regarding income tax refund, you can call the toll-free number 1800-180-1961. Or you can email [email protected].

To read about income tax exemption on gifts from parents and relatives, please click here.

To read about how to save income tax for salaried employees, please click here.

February 3, 2019 12:50 pm

Why not ricived ITR payment why are issues?