This article explains the use of Form 15G and Form 15H, the difference between the two, eligibility, and how to submit them.

[toc]

Form 15G and Form 15H: what exactly are these?

The basic purpose of both these forms is to prevent TDS from being deducted (only on meeting certain conditions).

Let’s take the example of TDS being deducted on bank interest.

- Banks have to deduct TDS if your interest income in a year is more than Rs.10,000. This includes income from your deposits in all it’s branches.

- However, the minimum taxable income limit is greater than Rs.10,000.

- So if your total income is less than the taxable limit (for that particular year), you don’t have to pay any tax.

- In that case TDS should not be deducted from your interest income.

- This is when you can submit Form 15G or Form 15H to the bank requesting them not to deduct TDS.

What is the difference between Form 15G and Form 15H?

- Form 15H is for senior citizens (those who are 60 years or older).

- Form 15G is for everyone else.

Who can submit Form 15G?

To submit Form 15G, you should meet the following requirements:

- You should be an individual or HUF.

- You should be a resident Indian, and less than 60 years old.

- Your tax liability (tax calculated on your total income) should be nil.

- Your total income/interest for that year should be within the minimum tax exemption limit for that year.

- You should have a PAN.

Who can submit Form 15H?

To submit Form 15H, you should meet the following requirements:

- You should be an individual, and a resident Indian.

- You should be 60 years old (or going to be 60 years old in the year for which you’re submitting the form).

- Your tax liability (tax calculated on your total income) should be nil.

- You should have a PAN.

When to submit Form 15G / Form 15H?

- You should submit the form as soon as the financial year starts. This is to ensure that the bank doesn’t deduct any TDS.

- Both these forms are valid for only 1 financial year. So you have to submit them every year if you are eligible.

How to fill Form 15G / Form 15H?

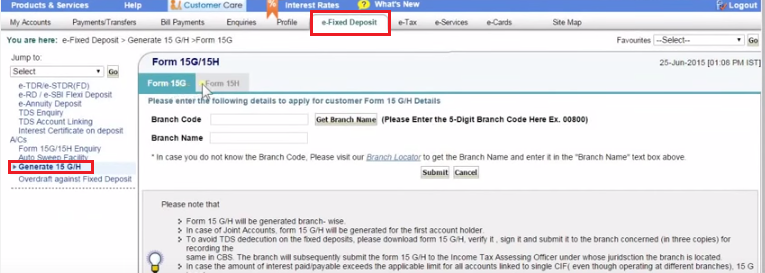

Nowadays, many banks like SBI and ICICI Bank allow you to submit it online via net banking. In case of joint accounts, the form is generated in the name of the first account holder. Also, the form is generated branch-wise.

However, if you are submitting it physically, you have to submit it at each branch where you have deposits (and get interest income). You can just go to the bank, ask for the form, fill it up, and then submit it. Attach a copy of your PAN card.

Remember, you have to submit it to the bank (TDS deductor), and not to the Income Tax Department.

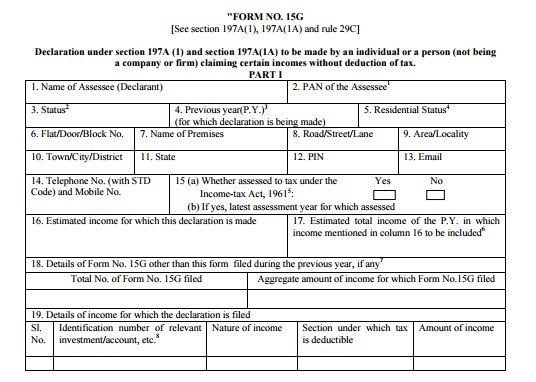

Sample Form 15G

To download Form 15G, please click here.

To download Form 15H, please click here.

Details to be filled in the form:

- Name of Assesse/Declarant – It should match the income tax records.

- PAN

- Status – Individual or HUF

- Previous Year -This means the current financial year for which you are filing the form.

- Residential Status

- Address details – Flat/Door/Block No, Name of Premises, Road/Street/Lane, Area/Locality Town/City/District, State, PIN

- Telephone number

- Whether assessed to tax under the income tax act, 1961 – If your income was above taxable limit in any of the past 6 years, answer this question with ‘Yes’.

- If yes, latest assessment year for which assessed – Mention the year.

- Estimated income for which declaration is made.

- Estimated total income of the previous year in which income mentioned in column 16 to be included – Calculate your total income from all sources – salary, interest income, etc for the year.

- Details of Form 15G other than this form filed during the previous year, if any – State the total number of Form 15Gs you have filed, and the total income for which Form 15G was filed.

- Details of income for which declaration is filed – Mention ‘Identification number of relevant investment/account etc’, ‘Nature of income’, ‘Section under which tax is deductible’, and ‘Amount of income’. You can mention fixed deposit account number, details of NSCs, life insurance policy number etc.

- Signature – If you are signing on behalf of an HUF, you have to mention your capacity.

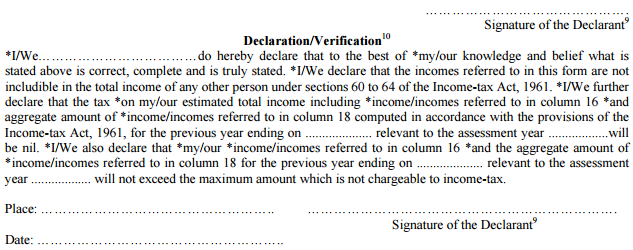

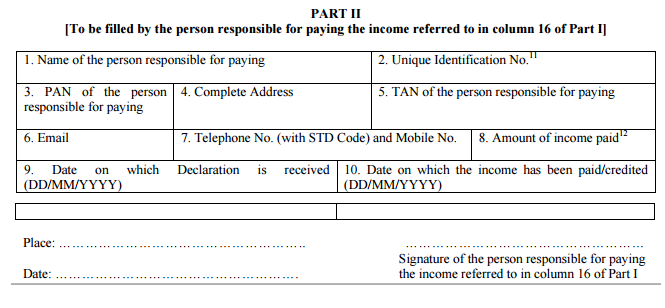

After this, fill up and sign the declaration. But do not fill the Part 2. The deductor (to whom you have submitted the form) will fill that.

Forgot to submit Form 15G / Form 15H?

If you are eligible for submitting Form 15G/Form 15H, but have forgotten to do so, don’t worry! You can get an income tax refund. Please click here to read about how to get an income tax refund.

Also, submit your Form 15G/Form 15H as soon as possible. (TDS is generally deducted on a quarterly basis.)

What are different purposes for which you can file Form 15G/15H?

Other than interest earned on bank deposits, TDS is deducted on other sources of income too. You can file Form 15G/15H under the following situations:

TDS on EPF Withdrawal

- If you withdraw your EPF balance before completing 5 years of continuous service, TDS is deducted on the amount.

- In such a case, if you plan to withdraw a balance of more than Rs.50,000, you can submit Form 15G/15H.

- However, the tax on your total income (including EPF balance withdrawn) should be nil.

TDS on Post Office Deposits

- Digitized Post Offices deduct TDS.

- And so if you are eligible, you can submit Form 15G/15H.

TDS on Income from Corporate Bonds

- If your income from corporate bonds exceeds Rs.5,000, TDS is deducted on it.

- So if the tax calculated on your total income is nil, you can submit Form 15G/15H.

TDS on Rent

- If your income from rent in a year exceeds Rs.1,80,000, TDS is deducted on it.

- So if the tax calculated on your total income is nil, you can submit Form 15G/15H to the tenants.

TDS on Insurance Commission

- If your income from insurance commission in a year exceeds Rs.15,000, TDS is deducted on it.

- So if the tax calculated on your total income is nil, you can submit Form 15G/15H.

To read about Income Tax exemption on gifts from parents and relatives, please click here.

To read an Income Tax saving guide for salaried employees, please click here.

Leave a Reply