Form 12BB is an important form for salaried employees to save tax. This article explains everything about it.

[toc]

Who should submit Form 12BB?

Salaried employees who want to claim tax deductions from TDS on salary have to submit Form 12BB to their employers. It is mandatory for employers to ask for this form before allowing any tax deductions.

What is Form 12BB?

- An employer has to deduct TDS before paying out the salary.

- Using Form 12BB, an employee can let the employer know about tax-saving investments or expenses that he/she is going to make in the coming year.

- According to that the employer will calculate TDS, then deduct it, and pay the salary.

- So Form 12BB is basically an investment declaration. It is a declaration of tax deductions claimed by the employee.

- It helps reduce TDS, and hence increase the in-hand salary.

Who should you submit Form 12BB to?

You have to submit this form to your employer, and not to the government/Income Tax Depatment.

When should you submit Form 12BB?

You have to submit this form near the end of the financial year (generally between January to March).

However, employers generally ask for a declaration of tax-saving investments and expenses around the beginning of the year. This is to estimate the TDS for the whole year. If the amount of tax deductions is greater than estimated, you can declare it in your final form at the end of the year, or claim an income tax refund.

Which tax-saving investments and expenses are declared in Form 12BB?

You should declare the following tax-deductible investments and expenses in Form 12BB:

Investments and expenses under Sections 80C, 80CCC, 80CCD, and 80D

- Section 80C –

Life insurance premium, investment in ELSS, PPF, or NPS, payment of children’s school tuition fees, etc. - Section 80CCC –

Annuity plan premium. - Section 80CCD –

Additional NPS contributions. - Section 80D –

Medical insurance premium.

Deductions under Sections 80E, 80G, and 80TTA

- 80E – Education loan interest.

- 80G – Donations to specified organisations.

- 80TTA – Interest income from savings bank account.

House Rent Allowance

You have to mention the rent amount along with the name, address, and PAN of the landlord.

Home Loan Interest

You have to mention the interest amount along with the name, address, and PAN of the lender.

Leave Travel Allowance

This will be as per your salary package.

How to fill Form 12BB?

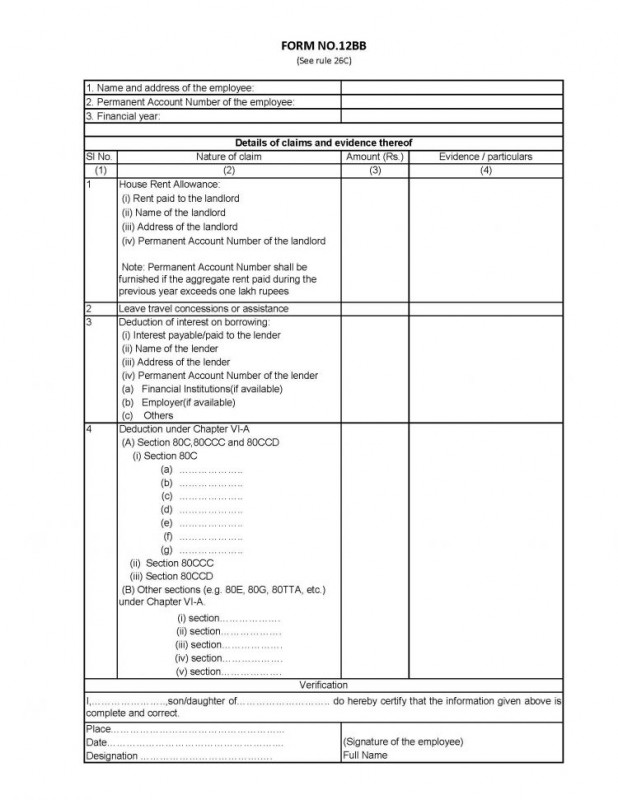

Generally you have to submit this form to the HR department of your company/employer. You can download it from the link given below. Keep in mind the following guidelines while filling the form:

- The first part includes your personal details and financial year.

- After that you have to fill up the part/parts relevant to your claims.

- For claiming HRA deductions, you have to submit your rent receipts.

- For claiming leave travel concessions or assistance, you have to submit proof of expenses towards travel.

- Under deductions of interest on borrowing, fill up the relevant details. For interest on home loan, you have to submit the interest certificate.

- For deduction under Chapter VI – A, you have to provide details and proof of investments.

- Then comes the signature.

Sample Form 12BB

Download Form 12BB

You can download this form in PDF format by clicking here.

Do your investments have to be equal to those declared in Form 12BB?

At the beginning of the year, you only have to make an estimate of the tax-deductible expenses and investments. The actual amount can be more or less. At the end of the year, when you submit the final Form 12BB, you can put in the exact amounts. And you also have to submit proof of the investments to your employer at the end of the year.

Did not declare investments on time? Excess TDS deducted?

In such a case, you can claim an income tax refund (refund of excess TDS) by filing your income tax return. Please click here to read about how to get an income tax refund.

To read about Form 15G and Form 15H, please click here.

To read about income tax exemption on gifts from parents and relatives in India, please click here.

And to read an income tax saving guide for salaried employees, please click here.

Leave a Reply