[toc]

Bajaj FinServ Personal Loan is a 100% end-to-end online Personal Loan solutions with instant approval. therefore All you need to do is fill an online form and also check your Personal Loan eligibility online. Once approved, a Bajaj Finserv representative finally will get in touch with you and collect the documents required for Personal Loan.

So,Here we give the detailed Idea about Bajaj FinServ Personal Loan,

Benefits and features

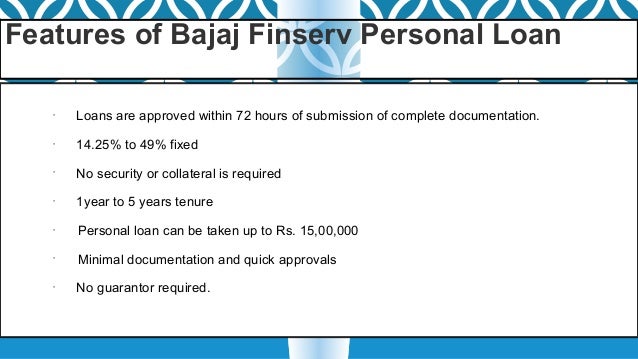

A Personal Loan is a great tool in managing your finances and also it acts as an impetus in putting your plans into actions. So,here are the List of Major benefits of Bajaj Finserv Personal Loan

Bajaj FinServ Personal Loan Eligibility

- One should be a Salaried individual or a Self employed individual or Self employed professional like doctor,lawyer,etc.

- Your Age should be above 18 years and

- You should have a good CIBIL credit score and

- You should have a good Repayment capacity with fixed and stable income source and

- Also you should be work for stable company.

Documents Required

For Personal loan one should have documents listed-

| Category | Documents Required |

| Financials | Salary slips of the last 2 months |

| Bank statements | Salary account bank statement of the last 3 months |

| Employment proof | Employee ID card |

| KYC | Identity proof (Any one of the below) Passport or Voters ID card or Driving license or PAN card |

| Address proof (Any one of the below) Passport / Driving license / Ration card / Latest mobile bill / Letter from employer (with HR / Admin sign) |

Intrest Rate and Charges

Below is the Lowest interest rate with bajaj finServ is a choice of many happy customers.

| Interest Rates | 11.99% – 16.00% |

| Processing fees | less then or equal to 2.00% |

| Foreclosure Charges | Upto 4% post 1st EMI clearance |

| Repayment Options | Upto 5 years |

| Maximum loan amount | Rs.25 Lakh |

| Turn Around Time | 48 hours |

| Min. Income | 40000 – For Metro and 30000 – for Small Cities |

Interest Rates March 2017

| CAT A | CAT B | Others |

| 11.99% -16.00% | 11.99% -16.00% | 11.99% -16.00% |

- Foreclosure Charges: 4% of Principle Outstanding for all product.

- Part Payment: 0% (Subjected to Less then 25% of Principle Outstanding on 1 April of every financial Year).

- 4% (Subjected to More then 25% of Principle Outstanding on 1 April of every financial Year)

- For Flexi Loan: 0% Part Payment Charges

How to Apply for Personal Loan

For applying Personal loan you can choose either Online mode or offline mode-

Online-

Bajaj Finserv online Personal Loan is very simple to apply and It probably takes 3 simple steps to get an instant Personal Loan approval-

- Click here to go to official site for applying online form. Fill-in all details and submit the form.

- Get an instant approval and also Select your required loan amount and tenure One representative will get in touch for document collection.

- Finally Money will credited to your account!

Offline-

Offline mode for a Personal Loan is also a very simple step either by :

- Calling us toll free on 18002660635.

- Sending us an SMS by messaging “SOL” to 9773633633.

- By giving a missed call on 9211175555.

FAQs

- Some FAQs are –

- What is an EMI?

- Ans-An EMI stands for Equated Monthly Installment, EMI provides you the ease and benefit of paying back since the Personal Loan amount in smaller convenient option and also this installment consists of both the principal and interest components.

- How much Time it take to get the Salaried Personal Loan?

- Ans- Consequently ,You will get instant approvals for all online applications.

- How can I pay secure fees?

- Ans- since we care for you all ,There are various way you can pay secure fees online Debit card or Internet enabled online bank-account.

- How do I repay the loan?

- Ans-You can repay the loan in Equated Monthly Installments (EMI’s) using the ECS facility and also through post-dated cheques.

- What is the procedure to convert Line of Credit to Term Loan?

- Ans-You can initiate a mail to our customer service (with your consent) to convert loan to normal loan application and also Customer service will take your consent and put a request on your behalf

- How much Time it take to get the loan if I apply online?

- Ans-Most noteworthy,You get instant approvals to your loan requests in 5 minutes and also All disbursements made within 72 hours of completion of internal verification.

- How can I check the status of my loan which I have applied online?

- Ans-You can check the status in multiple ways

You can call our Customer Care on 1800-103-3535 and also you can give your unique reference number provided to you by email and SMS on authentication of details like name and date of birth you will informed of the status of your account.

- How secure is the information provided by me?

- Ans-All your information will get secure and also The online application is a completely secured application using the state of the art security systems.

- What is a secure fee for online application?

- Ans-A secure fee is a charge require to pay for the submission of your application form online

- So, therefore this is required to process your loan online.

- What if I don’t pay the secure fees online?

- Ans- Once you choose not to pay the secure fee and also you will lose the benefit of instant online approval.

- What are the tenor and repayment options available?

- Ans- You can either choose a EMI and Repayment ranging from 12 to 60 months or You can also repay the loan in Equated Monthly Installments (EMI’s) using the ECS facility or through post-dated cheques.

June 23, 2017 12:06 pm

plese tek to personal lone